Explore ideas, tips guide and info Brenda R. Smith

Florida Sales Tax On Rental Property 2025. In the state of florida, all sellers of tangible property or goods (including leases, licenses,. For many years, florida imposed its sales tax on commercial rent at the same rate as its sales tax on tangible personal property so that both types of sales were.

In december 2025 the state reduced the sales tax rate on commercial real estate lease payments, which include base rent and additional rent, from 5.5% to 4.5%. There are a total of 362 local tax jurisdictions across the state,.

Commercial real property rentals in florida are subject to the state sales tax rate of 5.5%, along with any applicable discretionary sales surtax.

Florida charges a general state sales tax on every sale, admission, storage, or rental in florida that’s taxable.

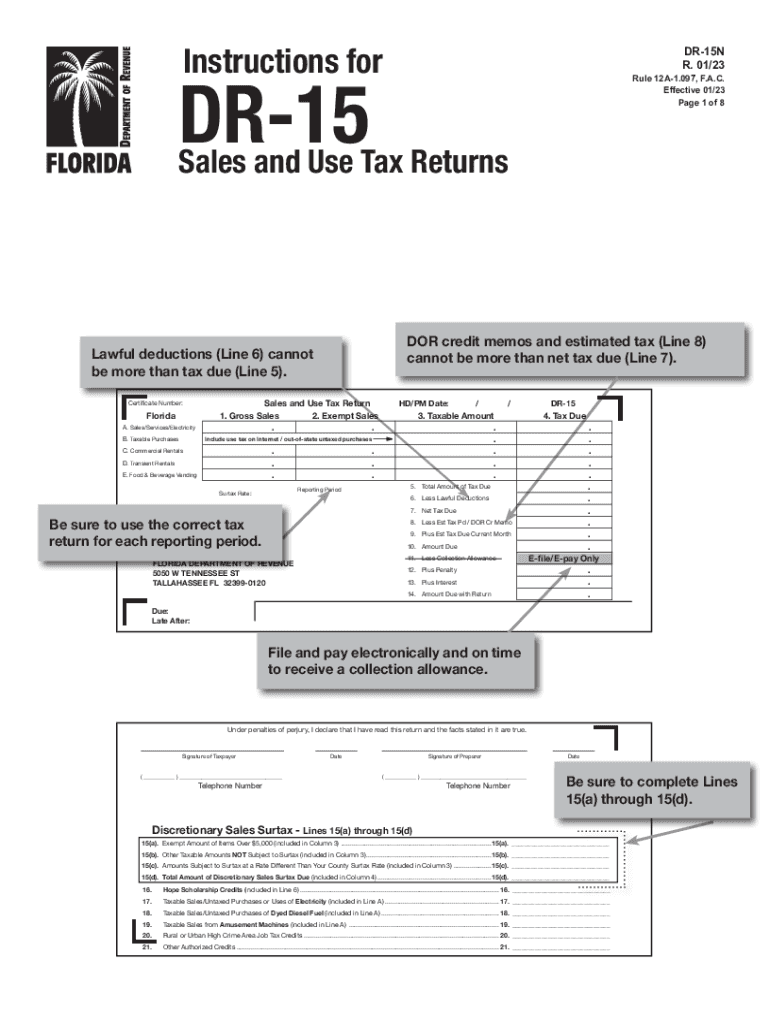

Florida Sales and Use Taxes What You Need to Know Ramsey, Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. If there is a county discretionary sales surtax, then the country discretionary.

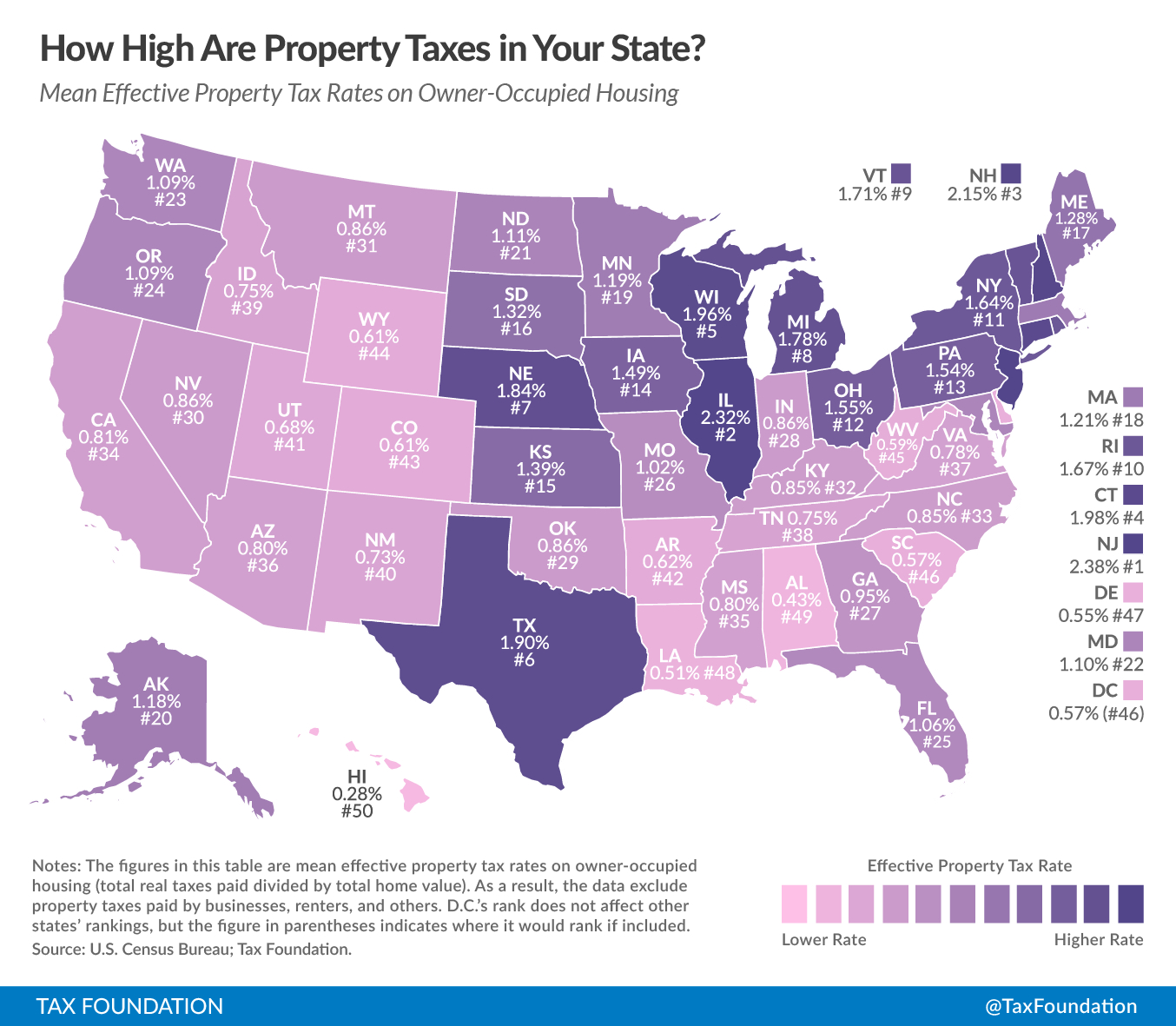

Sales Taxstate Are Grocery Items Taxable? Florida Property Tax Map, Florida charges a general state sales tax on every sale, admission, storage, or rental in florida that’s taxable. Specifically, florida levies a sales tax at the rate of 5.7% for commercial rent and allows counties to levy an additional surtax that ranges from 0% to 2.5%.

Florida Legislature Wants To Roll Property Taxes Into State Sales, As of december 2025, this rate will be lowered from 5.5% to 4.5%. Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt.

Florida Discretionary Sales Surtax 2025 Nissa Estella, Enter the property’s assessed value. Florida's general state sales tax rate is 6% with the.

Florida Sales Tax 20232024 Form Fill Out and Sign Printable PDF, As a reminder, sales tax due on commercial lease payments will soon be reduced. Therefore, total rent for one year is $57,000.

The 2025 Florida backtoschool sales tax holiday starts this week, As of december 2025, this rate will be lowered from 5.5% to 4.5%. Enter the property’s assessed value.

Florida Sales Tax on Commercial Rent What You Need to Know Orlando, In the state of florida, all sellers of tangible property or goods (including leases, licenses,. For several years the state reduced the commercial rental sales tax rate small amounts with a reduction to 5.5% (plus the local surtax) effective january 1, 2025.

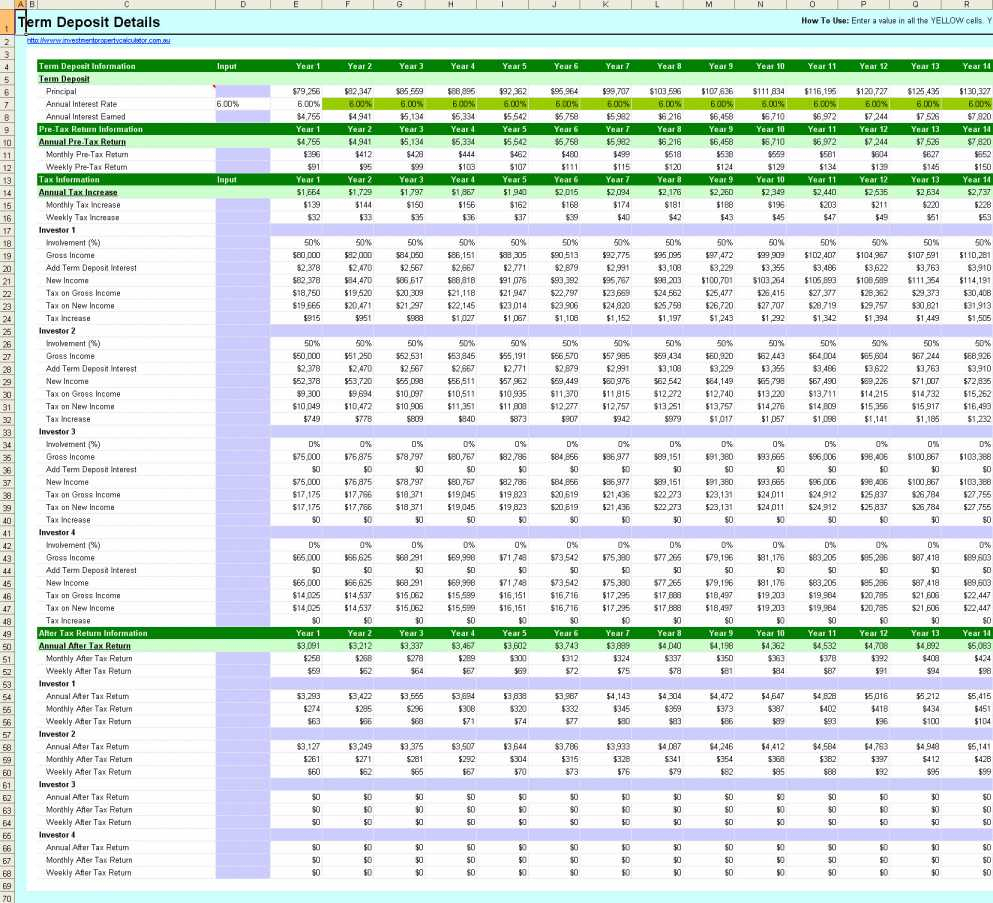

Tax Calculator Excel Template, If you’re renting out your property for short periods (typically less than six months), you. Instead, the 5% of sales is additional rent.

Sales Tax 101 for Florida Rental Property Owners Florida rentals, Here’s an overview of those taxes, what you. To calculate your florida property tax, you can use a florida property tax calculator.

How to File and Pay Sales Tax in Florida TaxValet Tax refund, Sales, Florida’s sales tax rates on commercial leases were reduced on december 1, 2025. Florida imposes its sales tax on the lease of or license to use real property.

Effective december 1, 2025, the state sales tax rate imposed under section 212.031, florida statutes (f.s.), on the total rent charged for renting, leasing, letting, or.